Account Receivable Reconciliation Process

Accounts Receivable is process of matching customer account balances with the general ledger balance. The reconciliation should be done at least monthly as part of the month-end closing procedures so any adjustments needed can be included in the correct period.

Below are steps to process accounts receivable reconciliation.

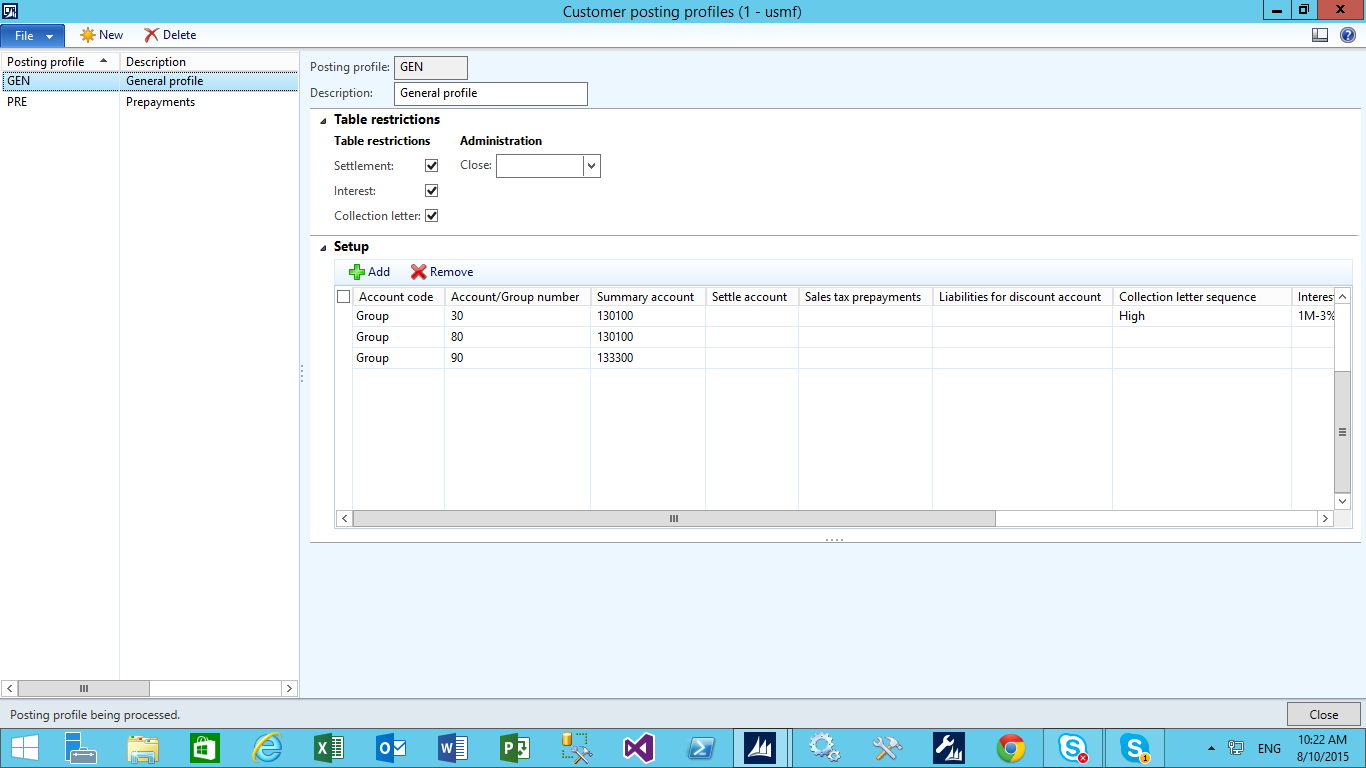

1. The Ledger accounts to be checked in the ‘Customer Posting profile’ accounts.

Navigation:

Accounts Receivable→ Setup→ Customer Posting Profile

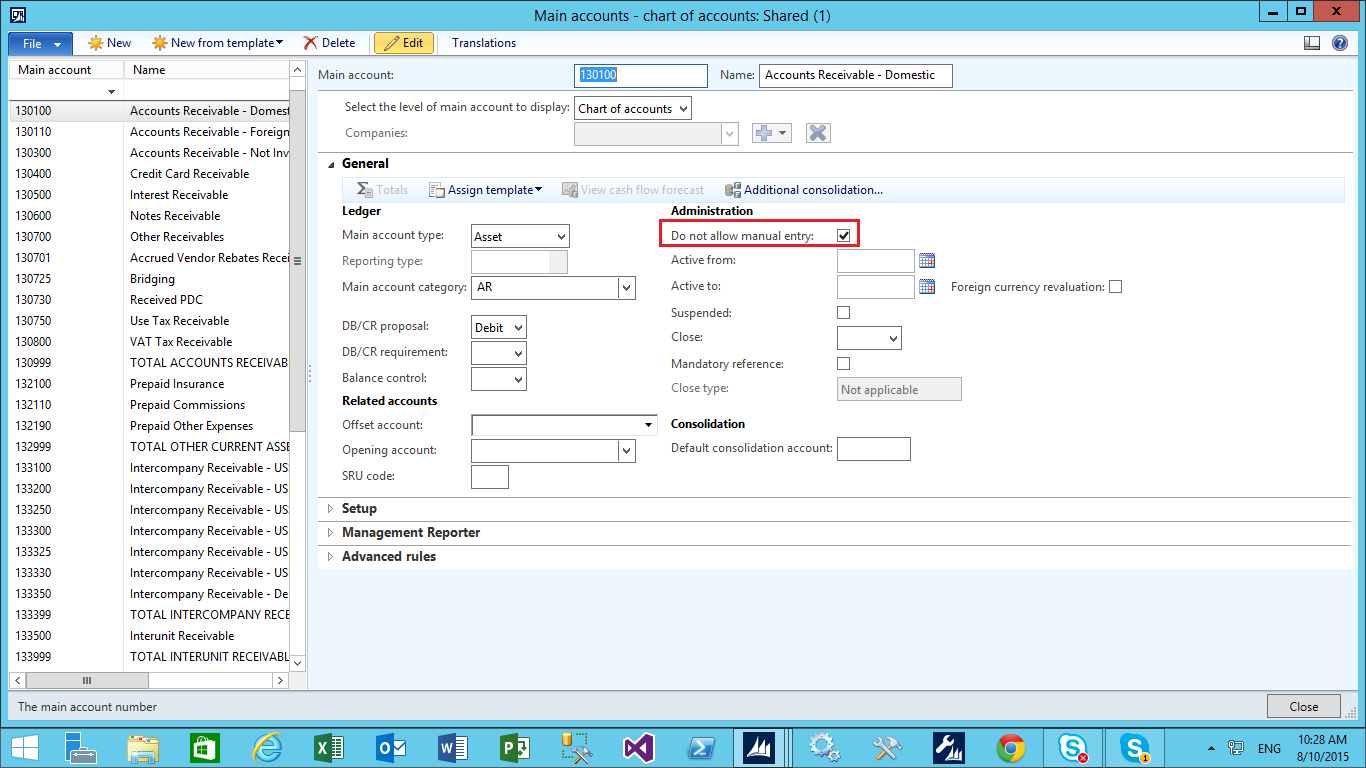

2. Summary accounts for Accounts Receivable should not be allowed for manual entry.

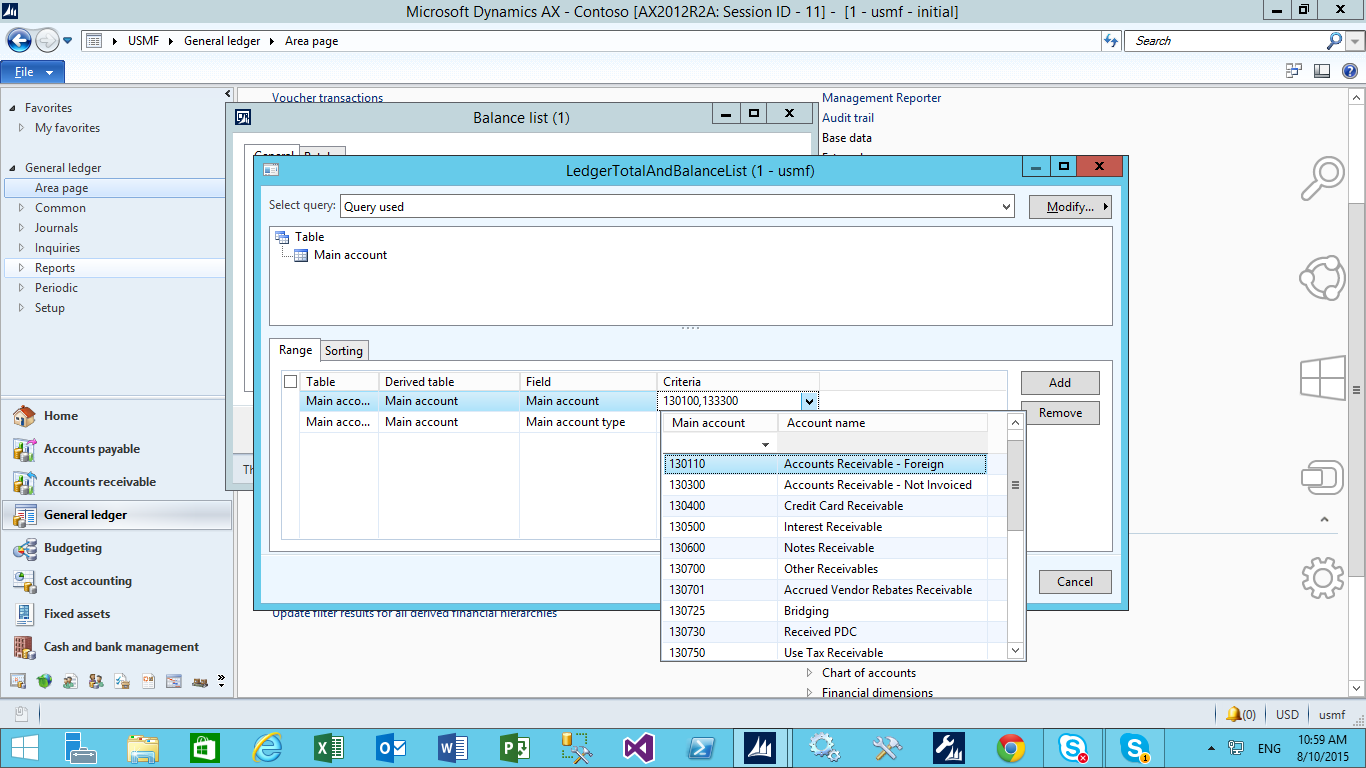

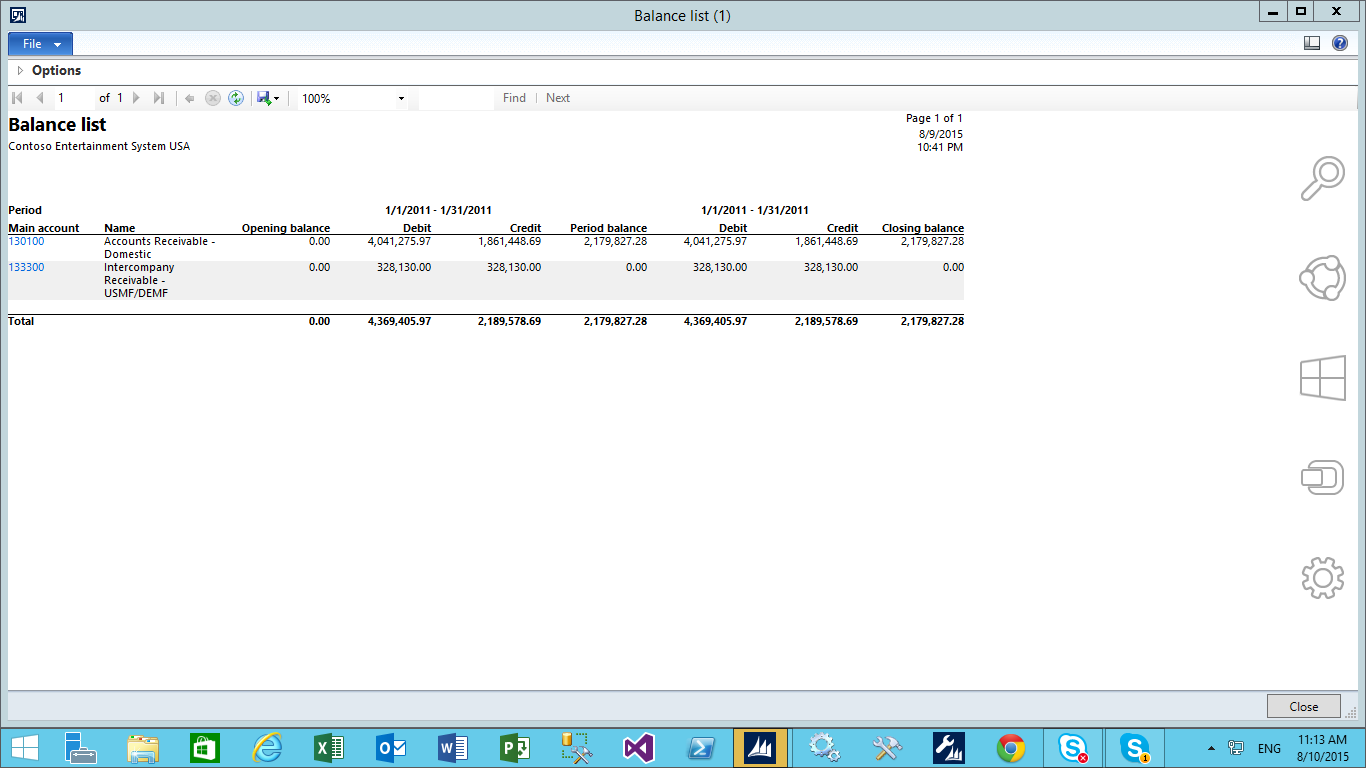

3. Run the report for ‘Balance List’ for the above ledger accounts.

Navigation

General Ledger→ Reports→ Transactions→ Balance List

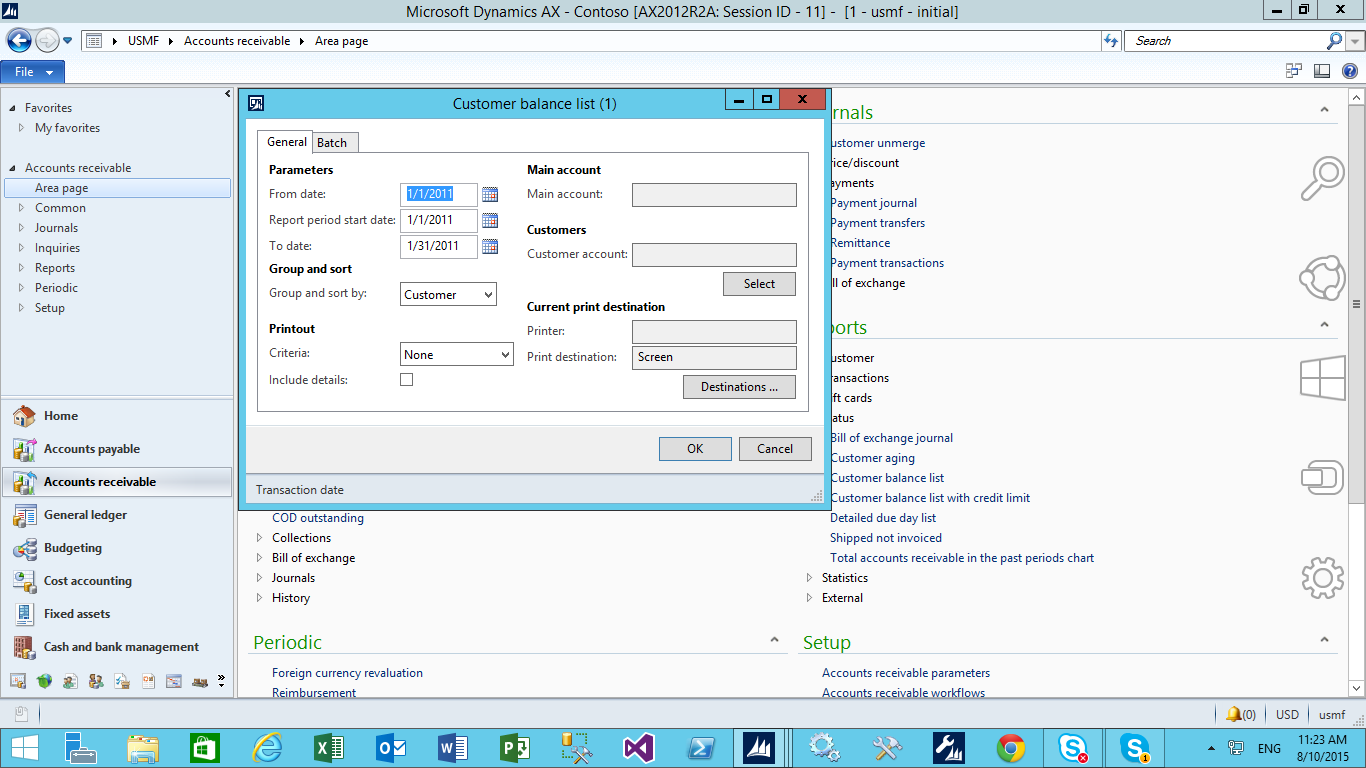

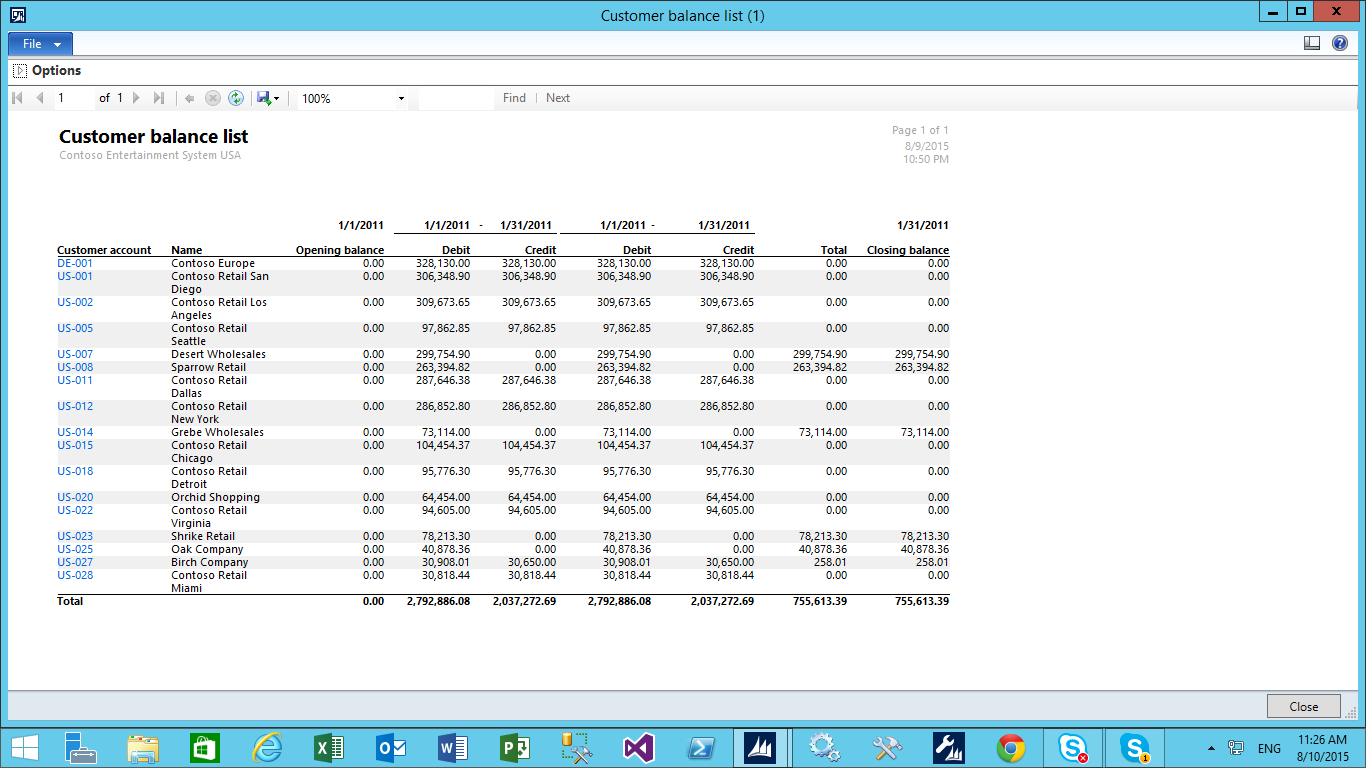

4. Now run the Report for Customer Balance List.

Navigation

Accounts Receivable→ Reports→ Status→ Customer Balance List

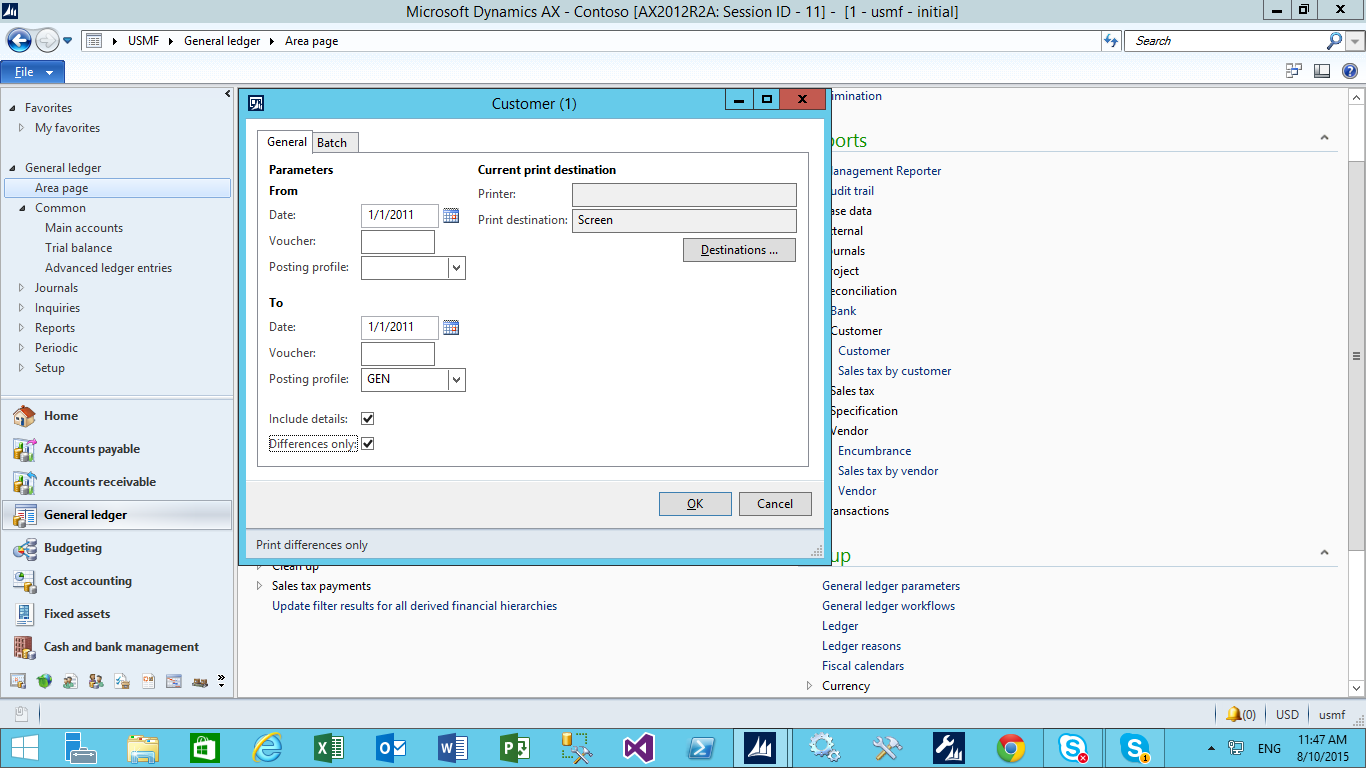

5. Run Customer-Ledger Reconciliation report

Navigation

General Ledger→ Reports→ Reconciliations→ Customer→ Customer

- Include Details

- Differences only.

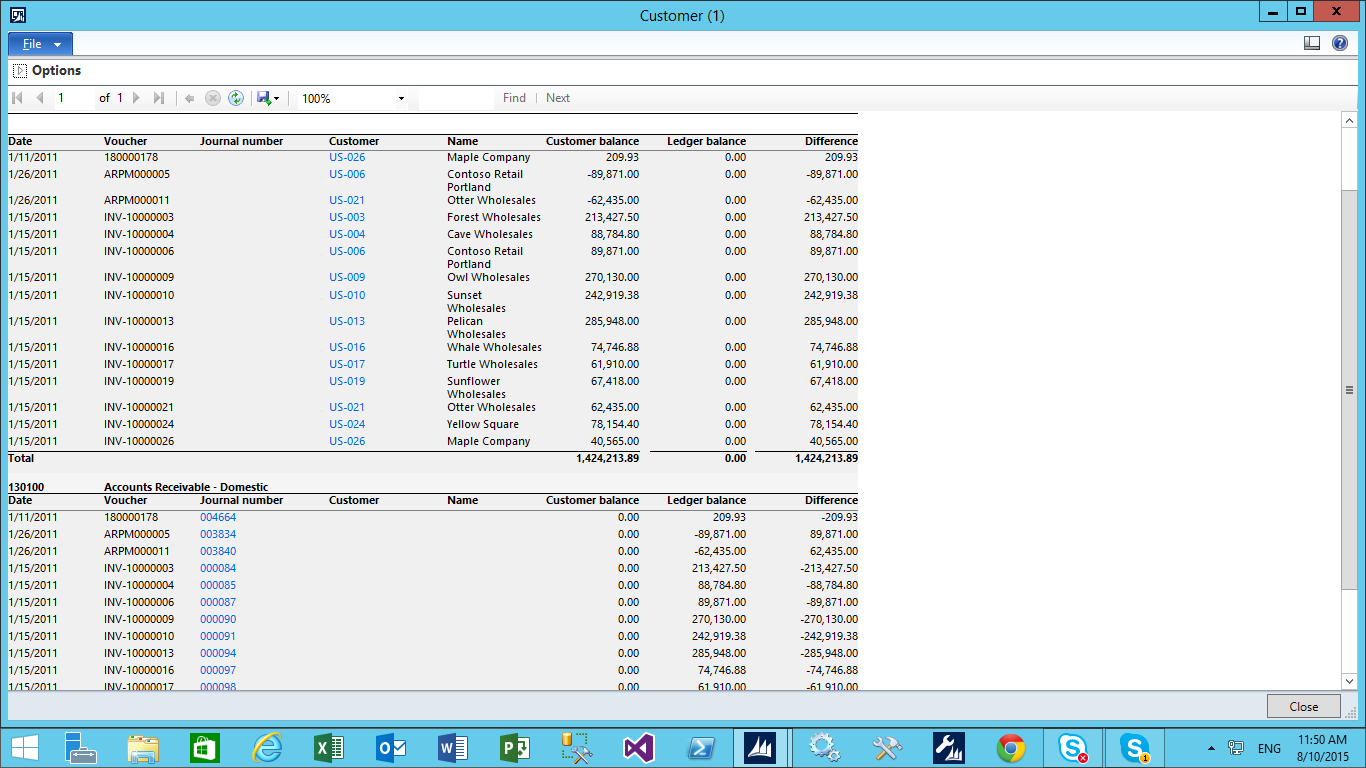

6. All the transactions with differences should be analysed to find the transactions.

The reasons for the discrepancies can be as follows.

- The posting profile changes (Change of ledger accounts in the posting profile during that period)

- Manual entries to the Ledgers

1. The posting profile changes

- Posting profile is a setup where the ledger accounts defined for the customer balances.

- A ledger account can be defined for all customers or for a group of customers or even for an individual customer.

- During a fiscal period, if the ledger account is changed for a customer in the posting profile; there arises a discrepancy in the customer account balances & their ledger balances.

2. Manual Journal

- Another reason for a discrepancies is a manual entry to the ledger account for the customer.

7. Steps to correct discrepancies

- A journal voucher can posted to transfer the balance from one ledger account

For example:

Suppose the ledger account defined for all customers is defined as ‘130100’ & after that for a specific customer group, a new ledger account is mapped; which is ‘130110’.

When the ledger account is changed, all the transactions for the customer group before the change would show discrepancies.

Solution: A journal voucher can be posted to transfer the balances between the two ledgers.

- The transactions with incorrect posting should be reversed & then they should be posted again.

Solution: A manual journal is required to be posted to transfer balances between the two ledger accounts.

Summary:

- You can use Account Reconciliation Process to check discrepancies before month end closing.

- Run Balance list report, Customer balance list and Customer reconciliation report to find discrepancies.

- Use journal to correct discrepancies or if possible then reverse posted transaction to correct discrepancies.