Leveraging Business Central’s Income Statement for Strategic Financial Insights

In today’s fast-paced business environment, reliable financial reporting is not just a compliance requirement it’s a strategic necessity. Organizations of all sizes, across industries, must make informed decisions quickly to stay competitive, manage risks, and ensure long-term sustainability. At the heart of this financial clarity lie two fundamental reports: the Income Statement and the Balance Sheet.

The Income Statement provides a snapshot of an organization’s financial performance over a specific period detailing revenues, expenses, and profits. It answers the critical question: “Are we making money?”

We’ll cover the customer journey from implementation to insight-driven strategy and include key steps and best practices.

Steps to Achieve goal:

Step 1: Understanding the Need – for any Financial Complexity

Before deploying any tool, Team should identified key challenges in their financial operations:

- Multiple revenue streams (passenger, cargo, loyalty programs)

- High-volume transactions across global markets

- Currency fluctuations and cost centers

- The need for real-time visibility into performance

Step 2.: Configuring the Income Statement

Once the foundational setup was complete, configuring the Income Statement enabled the organization to:

- Track Revenues by segment (first class, economy, freight, etc.)

- Monitor Operating Costs including fuel, maintenance, staffing, and airport fees

- Calculate Gross and Net Profits in real-time

Configuration Steps:

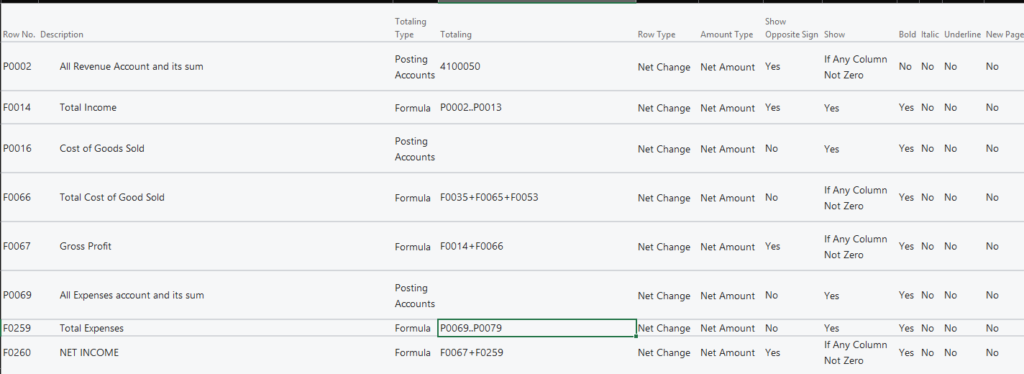

- Set up Account Schedules: Customize the layout of income statements.

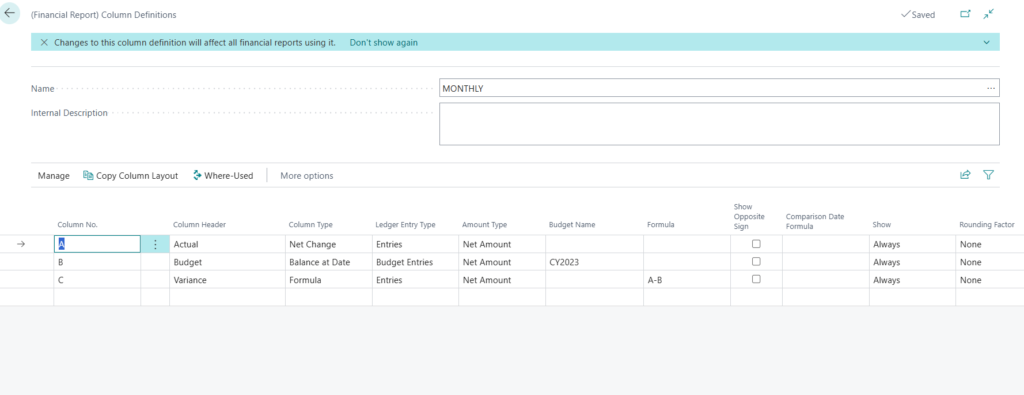

- Define Row and Column Definitions: Create separate row and column definition files to structure the Income Statement report effectively.

3. Enable Dimensional Reporting: Use dimensions to drill down into cost centers.

4. Schedule Reports: Automate delivery to leadership teams for weekly snapshots.

Step 3: Real-Time Financial Monitoring

One of the most significant value propositions for any system is providing real-time visibility.

Key Features in Action:

- Dashboards: Users can monitor key performance indicators relevant to their roles.

- Comparative Views: Easily analyze performance across different time periods or against set targets.

Step 4: Strategic Decision-Making with Insights

Optimize Routes: Identify profitable vs. underperforming flight paths

- Adjust Pricing: React to fuel cost volatility or competitor pricing

- Refine Budgeting: Make more accurate forecasts using historical trends

- Enhance Investor Confidence: Share detailed, transparent financial reports

Financial Reporting Best Practices for Modern Enterprises

- Invest in training to equip teams with the skills to effectively utilize dimensional and scheduled reports, and to confidently create their own reports independently.

- Focus on Clean Data: Ensure chart of accounts and dimensions are well defined

- Review Regularly: Use quarterly reviews to align financial data with strategy

- Leverage the Cloud: Utilize Business Central’s cloud-based accessibility for global teams

To conclude, accurate and timely financial reporting is essential for informed decision-making and long-term business success. With tools like Microsoft Dynamics 365 Business Central, enterprises can turn financial data into strategic insights that drive growth and efficiency.

We hope you found this blog useful, and if you would like to discuss anything, you can reach out to us at transform@cloudfonts.com.