GST- Goods and Service Tax Implementation Update Procedure for Microsoft Dynamics NAV 2016 India

Introduction:

Goods and Service Tax (GST) will be applicable at national level. It is a consumption based tax levied on sales, manufacture and consumption of goods and services. This tax will act like a substitute for all indirect tax levied by the government. GST patch has been released and is a part of the cumulative update 17 for Microsoft Dynamics NAV 2016.

Pre-requisite:

1. Microsoft Dynamics NAV 2016 (IN version)

2. Cumulative Update 17 for Microsoft Dynamics NAV 2016 IN

Purpose:

The purpose of the blog is to explain the procedure to update the GST patch on Microsoft Dynamics NAV 2016 IN.

Procedure:

-

- Download the Cumulative Update 17 for Microsoft Dynamics NAV 2016 IN (CU 17 NAV 2016 IN.zip) from

here. - Unzip the folder.

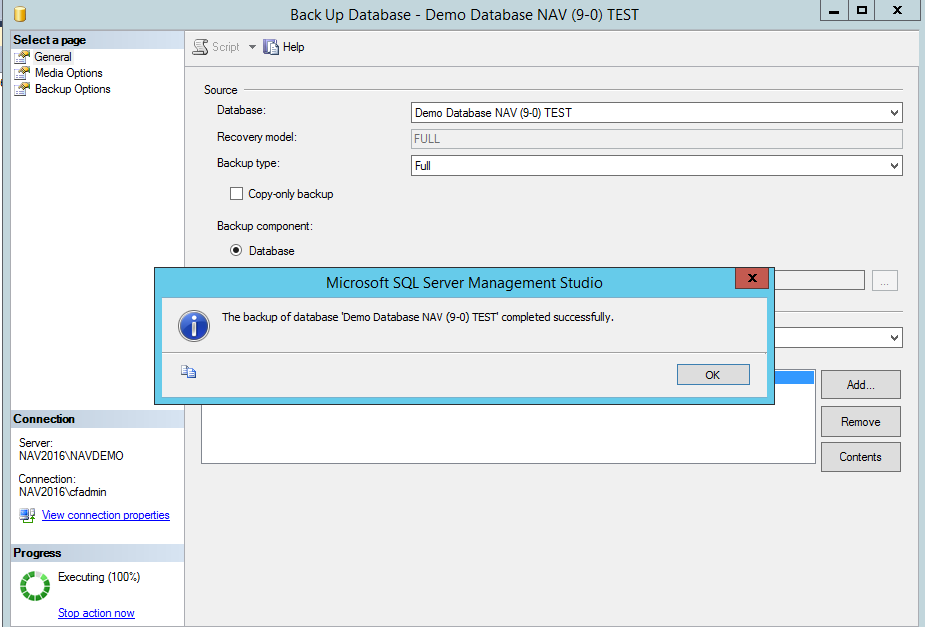

- Take SQL backup of the complete NAV 2016 database to ensure nothing is lost after the Cumulative update 17 which includes GST patch has been installed.

- Download the Cumulative Update 17 for Microsoft Dynamics NAV 2016 IN (CU 17 NAV 2016 IN.zip) from

Fig 1: SQL Backup of database

-

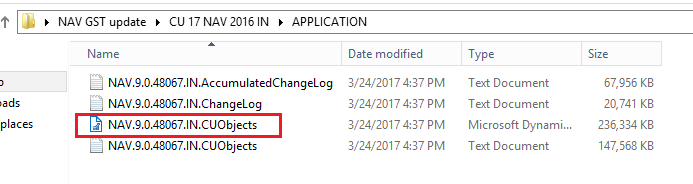

- A cumulative update includes files that are separated into the following folders i.e. ‘APPLICATION’ and ‘DVD’.

- Application folder includes the following files:

Fig 2: Application folder

-

- To install application files, follow below steps:

- Unmodified databases:

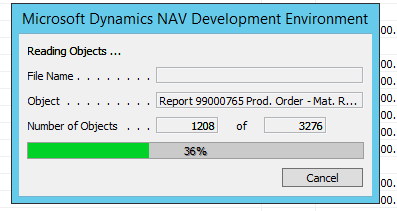

Import the CUObjects.fob file (highlighted in Fig. 3) into unmodified Microsoft Dynamics NAV 2016 database and replace the existing objects in the database with the cumulative update objects.

Fig 3: CUObjects.fob file in Application folder

- Modified databases:

Import the CUObjects.fob file (highlighted in Fig. 3) into the modified database. Replace the objects in the database that have not been modified.Compare and merge the cumulative objects with the objects in the database that have been modified.

If a table in the cumulative update has a new field and the same table in your database has been modified, use the Merge: Existing<-New or the Merge: New<-Existing options to import the new fields.

Fig 4: Reading objects process after selecting file to be imported

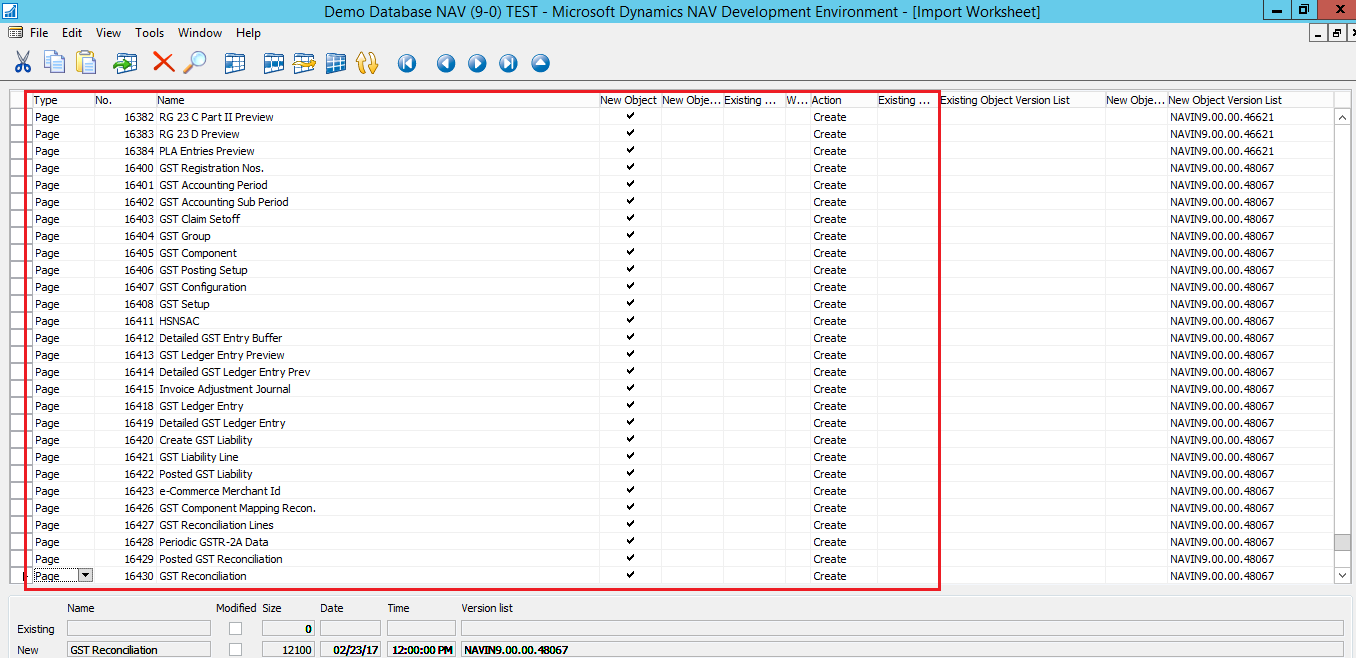

Fig 5: Import Worksheet which shows the GST patch objects

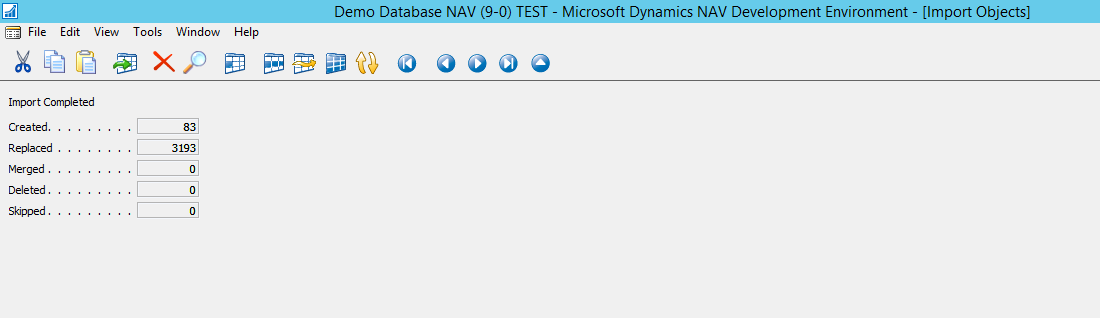

Fig 6: Number of objects created and replaced after import of objects has been completed

- Unmodified databases:

- All objects in the database have to be compiled after the import process has been completed.

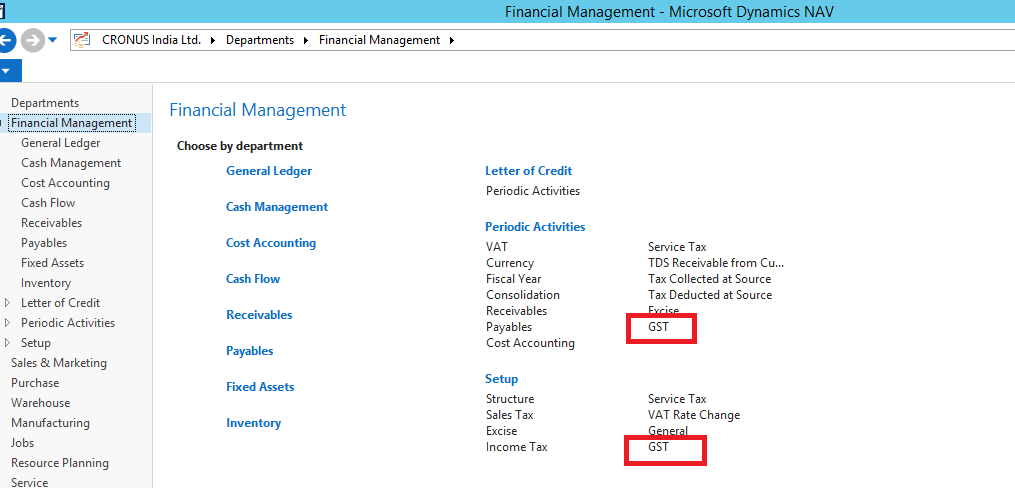

- Now in the Microsoft Dynamics NAV desktop client and web client, GST patch will be available under Financial Management Department.

- To install application files, follow below steps:

Fig 7: GST patch available in NAV under Financial Management Department

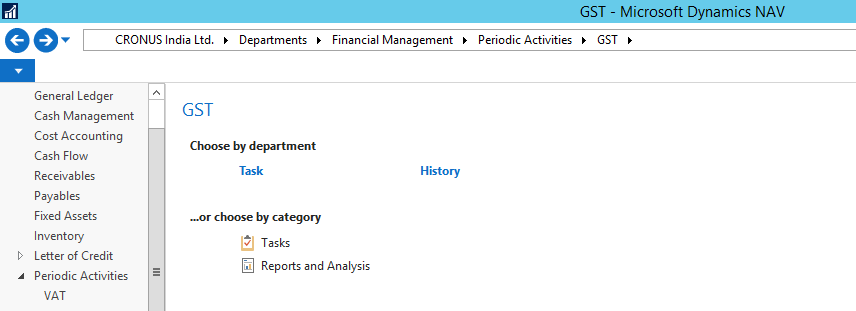

Fig 8: GST

Using the above mentioned steps, GST patch can be installed in the Microsoft Dynamics NAV 2016 (IN version).